Rwanda, often hailed as one of Africa’s most dynamic success stories, has undergone remarkable transformation since the devastating genocide of 1994. With a population exceeding 14 million and a GDP growth averaging over 7% annually in recent years, the country is hurtling toward upper-middle-income status by 2035 as part of its ambitious Vision 2050.

Central to this vision is addressing the housing crisis fueled by rapid urbanization. In 2012, only 18.4% of Rwandans lived in urban areas; by 2024, this figure reached 35%, adding roughly 2.7 million urban dwellers and creating a staggering demand for new homes. Projections indicate a need for 150,000 new dwelling units annually through 2050 to accommodate a population of 22.1 million, with urban areas requiring 3.2 million units alone.

Enter Rwanda’s Social and Affordable Housing Program, spearheaded by the Rwanda Housing Authority (RHA). Launched to tackle housing deficits for low- and middle-income families, the program integrates policy reforms, public-private partnerships, international financing, and innovative designs. It not only aims to construct thousands of units but also to foster sustainable, climate-resilient communities.

As of September 2025, with over 10,000 homes slated for completion by 2026, the initiative stands as a cornerstone of Rwanda’s socio-economic blueprint.

Rwanda’s housing journey is rooted in post-genocide reconstruction, where shelter symbolized national renewal. The 2000 National Housing Policy laid the groundwork, emphasizing equitable access and urban planning. By 2012, the Economic Development and Poverty Reduction Strategy (EDPRS2) identified housing as a poverty alleviation tool, leading to the establishment of the RHA in 2017 under the Ministry of Infrastructure (MININFRA).

The program’s formal inception came with the 2018 National Strategies for Transformation (NST1, 2017-2024), which targeted a 35% urbanization rate by 2024 while addressing a projected shortfall of 700,000 units by 2028—70% of which fall into the affordable category. Influenced by a 2018 Kigali housing market study by the International Growth Centre (IGC), the policy shifted focus from elite developments to incremental housing models, where families build progressively using serviced plots.

Key legislative pillars include the 2020 Manufacture and Build to Recover Programme, offering VAT exemptions on local materials and incentives for investments over Frw1.32 billion (US$1 million). A 2023 property tax of 0.5% on residential values funds infrastructure, while the Kigali Master Plan 2050 prioritizes high-density, mixed-use zones. Internationally, Rwanda’s low corruption (Corruption Perception Index of 53) and business-friendly environment – ranked 38th globally by the World Bank – bolster investor confidence.

These frameworks converge in the Affordable Housing Program, which subsidizes infrastructure for projects over 100 units priced below Frw40 million (US$30,000), promoting technologies like aerated autoclaved concrete for cost efficiency.

The RHA orchestrates a multifaceted approach, blending government-led construction with private sector innovation and global partnerships. At its heart is the Affordable Housing Program, which facilitates homeownership through low-interest loans, land allocation in peri-urban areas like Ndera and Busanza, and amenities such as transport corridors.

Funded by a US$150 million World Bank grant since 2020, the RHFP is the program’s financial backbone. It comprises three components: long-term finance (US$126 million), technical assistance (US$4 million), and infrastructure support (US$20 million). By mid-2025, it had financed 8,098 loans—exceeding its 6,000 target—with average maturities of 12 years at subsidized 11% rates, up from a 16% market average. The Development Bank of Rwanda (BRD) issued US$10 million in bonds, enhancing liquidity for seven participating institutions.

Innovative urban developments include:

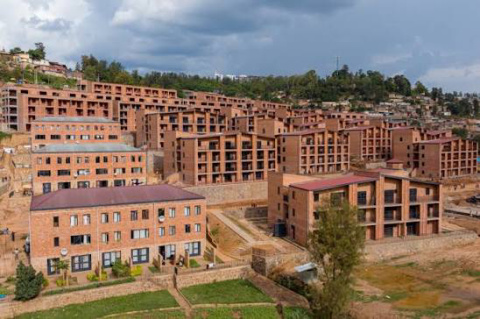

Masaka Affordable Housing: A trailblazing private-sector project by MASS Design Group in Kigali’s Kicukiro District, Masaka spans 26,750 sq m and integrates diverse typologies for varying family sizes. Using low-carbon, locally fabricated materials, it reduces embodied carbon by 57% versus national averages. Features include community gardens, laundry hubs, and permeable paving for flood resilience. As Rwanda’s first profitable affordable model, it catalyzes developer buy-in.

Rugarama Park Estate: A 2,800-unit joint venture near Kigali, targeting incomes of Frw200,000–700,000 (US$149–522) monthly. Units range from Frw12–35 million (US$8,942–26,080), with rent-to-own options and compliance with the Master Plan.

Bumbogo and Busanza Projects: Government-backed sites providing 1,000+ units with subsidized infrastructure, though Bumbogo faces delays.

Other notables include See Far Housing, Bwiza Riverside, Izuba City, and the Mpazi Informal Settlement Upgrading, which serves 35,000 residents across 137 hectares with World Bank aid.

The German GIZ project (2021 – ongoing, €5 million) promotes climate-sensitive planning in secondary cities like Muhanga and Rubavu. It trains planners, develops rental guidelines for women, and fosters participatory neighborhood design to combat unplanned settlements housing 60% of urbanites (3.7 million people). The Urban Lab Initiative, involving CAHF, University of Rwanda, and MININFRA, prototypes models and refines policies.

| Key Projects | Location | Units Planned | Target Income | Unique Features |

|---|---|---|---|---|

| Masaka Affordable Housing | Kigali (Kicukiro) | 1,000+ | Low-Middle | Low-carbon tech, community gardens |

| Rugarama Park Estate | Near Kigali | 2,800 | Frw200k–700k/month | Rent-to-own, mixed-use |

| Bumbogo Housing | Kigali outskirts | 500+ | Low | Subsidized infrastructure |

| Mpazi Upgrading | Kigali | N/A (upgrades) | Low | Services for 35,000 residents |

| Green City Kigali | Kigali | 2,000 | Varied | Eco-certified units |

By September 2025, the program has delivered tangible gains. Urban housing supply has risen from 3,000 annual units in Kigali to broader national efforts yielding over 5,000 units in 2024, with 10,000+ projected by 2026. The RHFP’s 127% surge in housing loans since 2018 has empowered 90% beneficiary satisfaction, per surveys. Financial inclusion hit 96%, with mobile money at 98% penetration aiding remittances for construction.

Mortgages jumped 33% to 36,331 in 2023, with outstanding residential loans at Frw527 billion (US$394 million). For low-income groups – defined as below Frw100,000 (US$75) monthly – upgrading initiatives like Mpazi have improved sanitation and utilities for thousands, reducing informal settlements’ share from 60% to targeted 40% by 2030. The real estate sector now contributes 4% to GDP, up from negligible levels a decade ago.

A 2020 World Bank study on low-income housing underscored these strides, noting that while supply lags demand (22,000 units needed yearly vs. 3,000 delivered), interventions like progressive building have housed 735,000 renting households affordably (Frw15,000-20,000 or US$11-15 monthly for 15-20m² units).

Despite progress, hurdles persist. High construction costs – driven by imported materials – and land scarcity inflate prices, with middle-income earners (teachers, civil servants) facing a mismatch: homes cost 10–15 times annual income. Component 3 of RHFP lags, with only 261 of 1,800 targeted units completed by July 2025 due to delays in Bumbogo.

Data gaps hinder planning; informal supply dominates, comprising 80% of units, yet lacks documentation. Climate vulnerabilities, like flooding in unplanned areas, affect 3.7 million urban poor, while rigid credit rules exclude many. The rental sector, vital for 735,000 households, receives scant policy focus.

Looking ahead, NST2 (2025-2030) and Vision 2050 prioritize 150,000 annual units, emphasizing green building via Green City Kigali’s 2,000 eco-units. Proposed reforms include a Mortgage Refinancing Company, digital platforms, and diaspora schemes. Incentives like 15% corporate tax for low-cost projects and 50% depreciation for large investments aim to scale private involvement.

By 2050, Rwanda envisions high-income status with inclusive cities, where social housing integrates net-zero goals and community-led planning. Full RHFP closure by October 2025 will inform scaling, potentially reallocating funds for rentals and upgrades.

Rwanda’s Social Housing Program exemplifies visionary governance, transforming a post-conflict housing deficit into a model of resilience and equity. From Masaka’s eco-villages to RHFP’s financial lifelines, it bridges gaps for millions, fostering dignity amid urbanization’s tide.

Yet, sustained investment in data, rentals, and climate adaptation is crucial. As President Paul Kagame often notes, Rwanda builds not just homes, but futures. With Vision 2050 as its compass, the program promises a housed, hopeful nation – proof that thoughtful policy can uplift the vulnerable in Africa’s rising star.

By Kenneth DeVand

© Preems